Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. Though it was there most of the taxpayers were not following it due to.

Tommy Hilfiger 1781743 Claudia Pvd Gold Plated Watch 180 Liked On Polyvore Featuring Jewelry Watches Tommy Tommy Hilfiger Uhren Uhren Herren Damenuhren

The GST law makes it necessary for registered taxpayers to issue invoices for the sale of goods or services.

. These depend on various. The seventh edition report of Women in the boardroom. Location Your.

Name of the Act Late fees for every day of delay. Now there are different types of invoices that are issued under the GST law. The Authority for Advance Ruling under GST Maharashtra in the case of Basf India Limited- 2018-TIOL-82-AAR-GST dated 21st May 2018 has held that goods sold on HSS by the HSS seller is a supply which is not taxable under GST ie non-taxable supply and is an exempt supply.

For all other back taxes or previous tax years its too late. If the supplier of goods or service is not paid within 180 days of the issue of the tax invoice the recipient has to reverse the ITC availed and show it in the GSTR 3B of the December 2017 to be filed by 20th January 2018. Straight2Bank Purpose of Payment Code Effective.

A Nil GST Return must be filed within the specified time frame even if there is no GST return amount to be paid to the tax authority. June 1 2018 More Customer Satisfaction Index CSI Survey Report for 2017. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə.

If you miss the deadline for filing your NIL returns you will be charged a late fee on a per-day basis. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. In total a late cost of INR 100.

Mike Plaster Nov 5 2018 Many areas in the country are undergoing a building boom which means your construction business might be booming too. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. This provision is similar to the provision we had in the erstwhile Service Tax.

Check out our HSN Code finder HSN stands for Harmonized System of Nomenclature which is an internationally accepted product coding system used to maintain uniformity in the classification of goods. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. This is because the tax invoice not only enables the seller to collect payments but also avail input tax credit under GST regime.

INR 50 is charged each day under the CGST Act while INR 50 is charged per day under the SGST Act. Decimal 123 Sample value is 50 The unit price exclusive of GST before subtracting item price discount cannot be negative. HSN Code List for GST in pdf HSC Codes in Excel Format Find HSN Code for Your Business.

See information about unclaimed refunds for details. Segala maklumat sedia ada adalah untuk rujukan sahaja. Thats a good thing but increased revenue can bring increased scrutiny from state and local tax officials.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. 18th Floor Menara UMW Jalan Puncak off Jalan P. Ramlee 50250 Kuala Lumpur Malaysia.

November 5 2018 More Change of Maxis Broadband Maxis payment service. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Unfortunately if you owe taxes there is no time limit.

The figure outperforms the Asian average of 117 and is closing in on the global average of 197. 1119724-A AJL 932143 GST Reg. This is only if you expect a tax refund.

LATEST UPDATE ON MALAYSIA GST Effective. Rs 25 Total late fees to be paid per day. IPMAT Application form 2022 fee is Rs.

The applicable HSN code for particular goodsservice must be entered. A global perspective also revealed that the percentage of women in board seats in Southeast Asia has fared better with an average of 171 compared with 143 in 2018. For SC ST and PwD category candidates the IPMAT exam 2022 application form fee is Rs2065- Rupees Two thousand sixty five only.

Input Tax Credit of common inputs capital goods and input services to the extent. 4130- Rupees Four thousand one hundred thirty only inclusive of GST for General EWS and NC-OBC category candidates. Central Goods and Services Act 2017.

Country Code Phone number. AND SAC stands for Service Accounting Codes which are adopted by. Decimal 132 Sample value is 5000 The price of an item exclusive of GST after subtracting item.

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

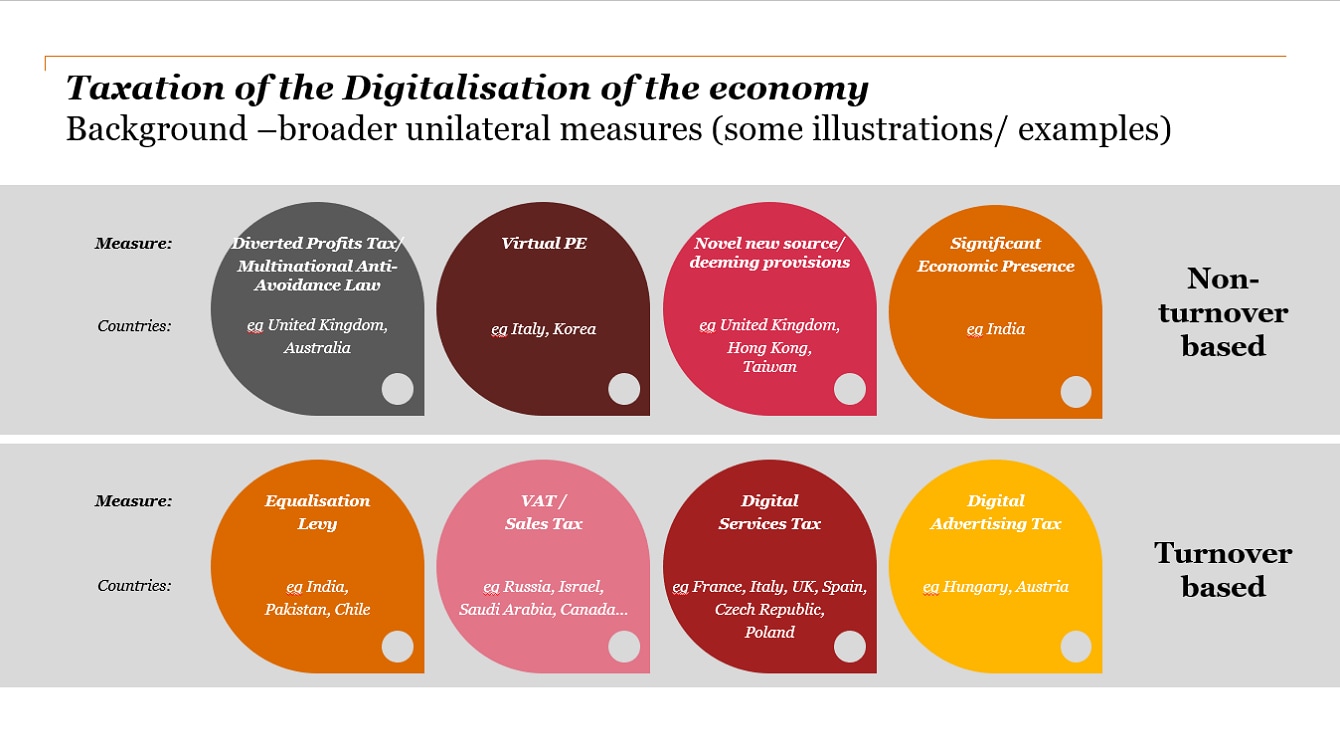

Taxation Of The Globalisation And Digitalisation Of The Economy Pwc

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

A Complete Guide On Gst Rate For Apparel Clothing And Textile Products

Payment Before 1st June 2018 Are Subject To 6 Gst Enagic Malaysia Sdn Bhd

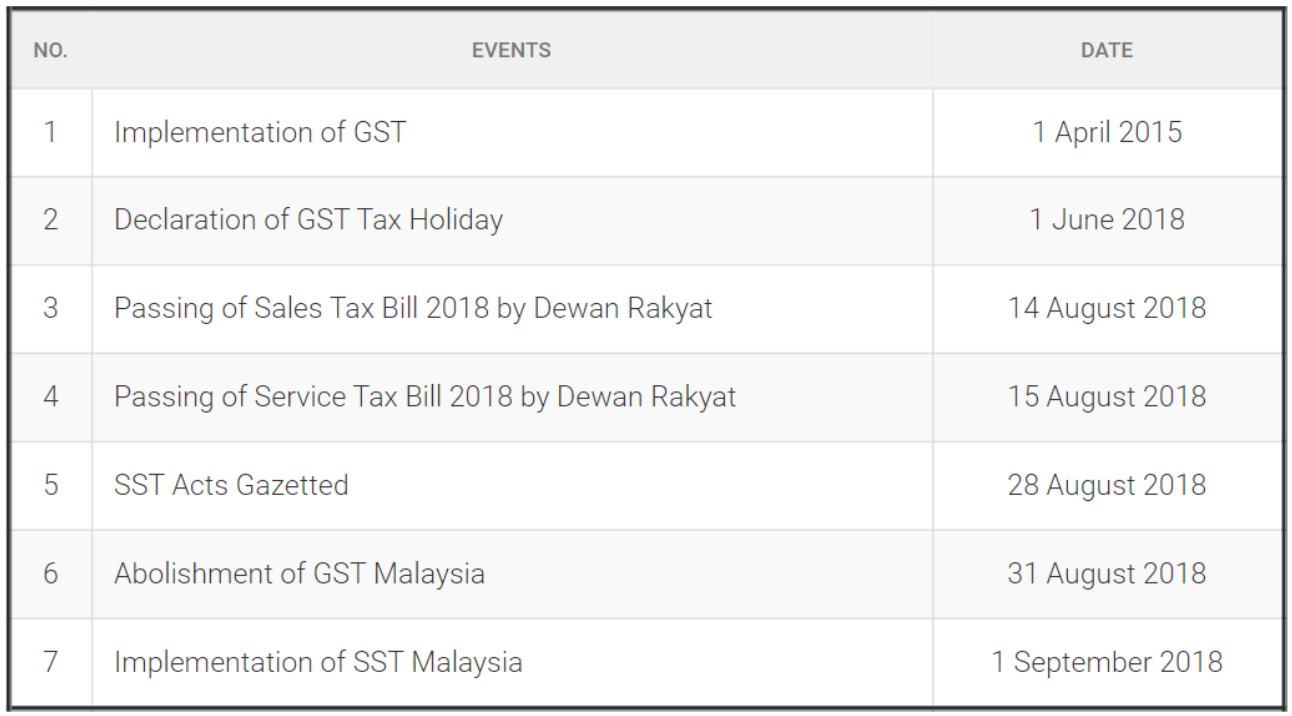

Malaysia Sst Sales And Service Tax A Complete Guide

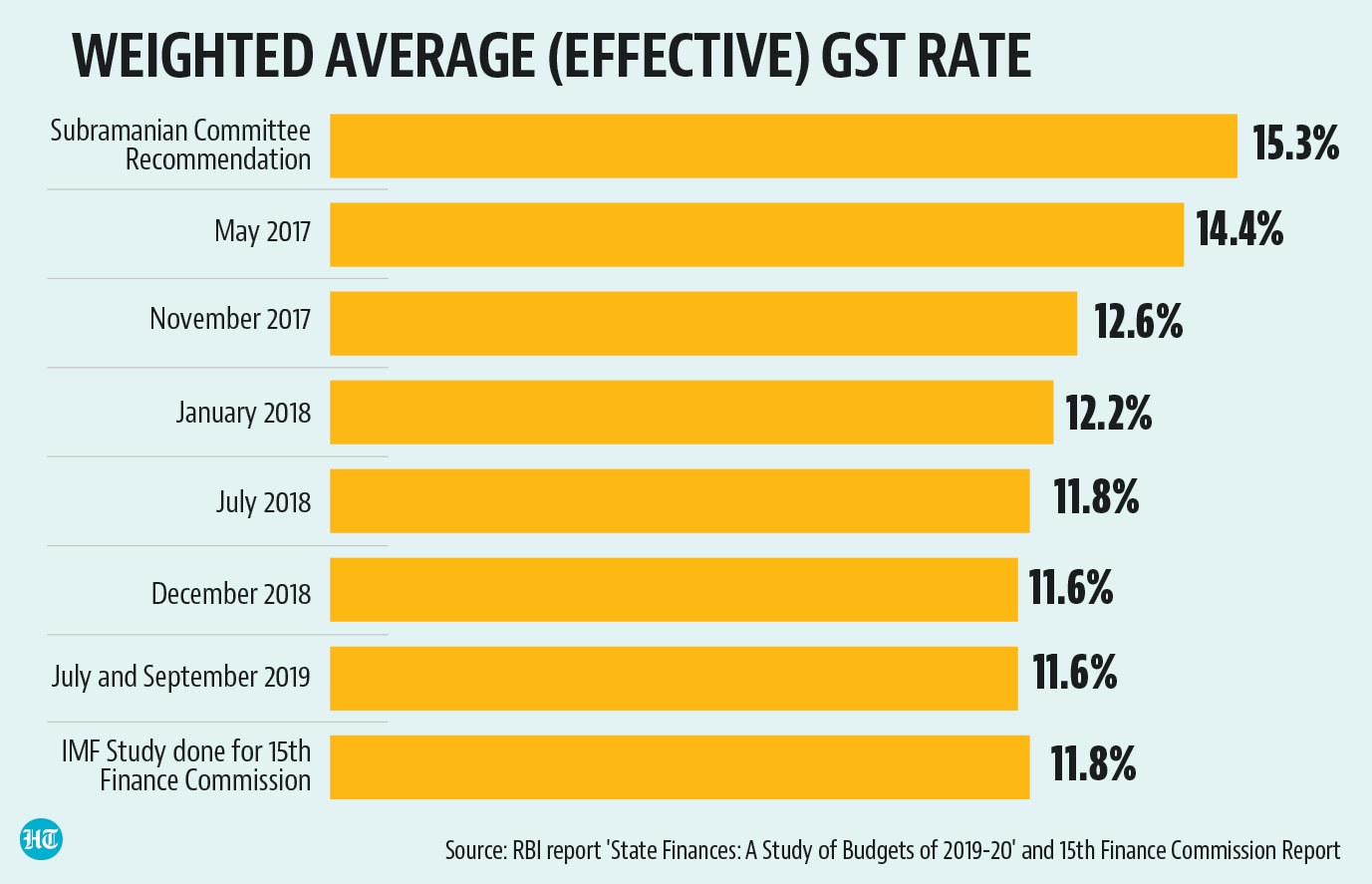

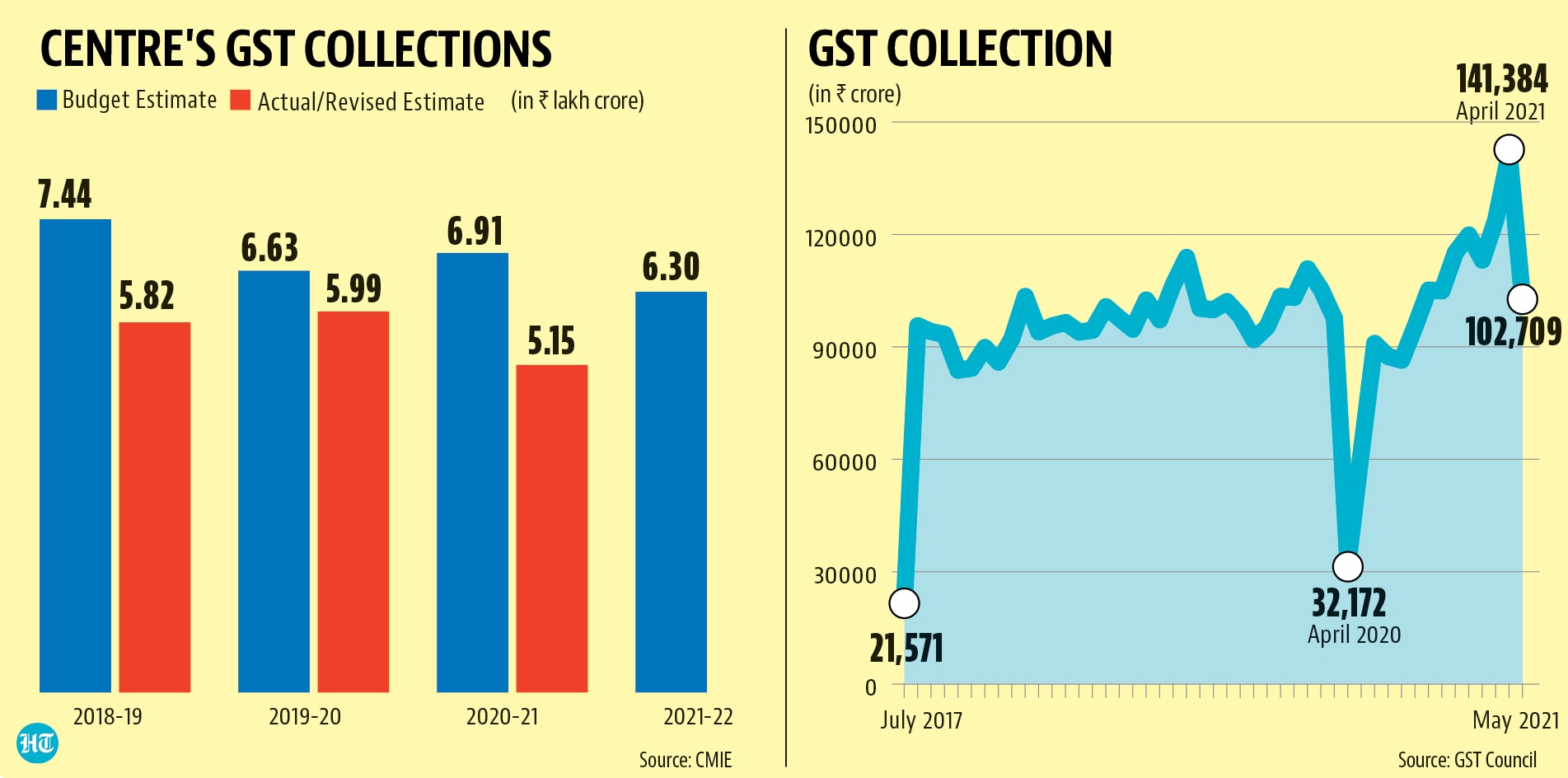

Four Years Of Gst Success Or Not Quite Hindustan Times

Income Tax Slab Rates In India Ay 2018 2019 Fy 2017 18 Ebizfiling

What India Can Learn From Failure Of Malaysia S Gst Mint

Malaysia Sst Sales And Service Tax A Complete Guide

Four Years Of Gst Success Or Not Quite Hindustan Times

Registering For Gst Video Guide Youtube

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Extension Of Due Date Of Filing Of Form Gstr 3b April 2018 Ebizfiling

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters